Statements Lie to You!

It is absolutely true that statements are NOT a reflection of reality. It sounds shocking, but consider this example (we could provide more). Statements are misleading because they do not reflect the taxes you pay on your portfolio and they also do not reflect investment expenses. Neither of these are line items you can observe on your statements.

Is your Advisor good? Your statements won’t tell you. In fact, they will lie to you.

A careful Advisor is aware of the value of asset location, tax efficient investing, and possesses a willingness to be thorough and investigate the details that separate a good investment from a perfect investment for clients. Maddening to us, all of these characteristics, extra effort, and the savings and value they provide is never specifically reflected on statements! In the same manner, the absence of these characteristics, considerations, and thoroughness results in lost opportunities, which do have a cost, and are equally difficult to discern because they are also not reflected on statements!

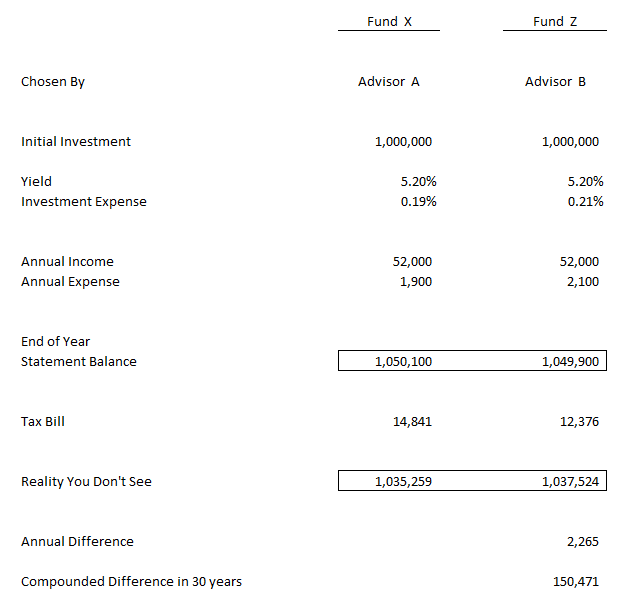

Allow us to provide a simple example – assume there are two Advisors, A and B. Both are independent and employed by an RIA. Both Advisors know that a mutual fund isn’t the best way to make this particular investment, but there are two exchange traded funds that fit the bill, Fund X and Fund Z. These funds are the largest funds in the category, both trade with plenty of volume, providing sufficient liquidity and minimal spread. Both funds yield the same and they are virtually identical with the exception that fund X has lower investment expenses (.19% versus .21%). Advisor A feels comfortable he has evaluated the situation and selects Fund X with lower fees. Advisor B continues the investigation, digging a little deeper, and determines that Fund X, which costs less, has QDI, or qualified dividend income, of 70% and Fund Z has QDI of 100%. This means that for every $100 of yield the investor in Fund X receives, they pay taxes on $70 at 23.8% and taxes on $30 at ordinary tax rates or 39.6%, which equates to total taxes of $28.54 per $100 of income. The investor in Fund Z pays taxes of just 23.8% on the entire amount, or total taxes of $23.80 per $100 of income. Assuming the following: an investment of $1M, Fund X has expenses of 19 basis points, or 0.19%, Fund Z has expenses of 21 basis points, or 0.21%, and after one year there is no change in the price of the asset.

If you only looked at the statements, it looks as if Advisor A did better for his client by choosing Fund X! In fact, each year it will appear to be even more convincing as the account balances continue to diverge and widen in favor of Advisor A!

How would you determine that Advisor B cared more for his client? He investigated more to learn there was a difference in the actual dividends of each fund and was further aware of the different tax treatment of those dividends, but the account statements and balances clearly show a larger balance for Advisor A? That is precisely what is maddening to us! Why is this?

Because you do NOT pay taxes out of this account!

When you pay taxes, most people pay them from another account and the statement balances do not include (subtract) the tax consequences of Advisor decisions. The tax bill the client must pay with the investment in Fund X purchased by Advisor A is $14,841. The tax bill the client must pay with the investment in Fund Z purchased by Advisor B is $12,376. The tax bill each investment creates is never presented clearly either – they are lost when combined with the hundreds of items on our tax returns. The final, actual, real, after tax difference between the two Advisors is $2,265. Advisor B has done better for his client in the real, after tax world we live in! Again – it is not reflected in the balance on the statement, in fact, the statements still reflect the same falsehood that Advisor A’s choice was more favorable!

$2,265 is not a huge sum, right? Well, this savings comes each and every year and compounds each year as well. The difference over 30 years @ 5% / year = $150,471. That is 15% of the original investment. Certainly, not trivial considering this is the result of just one single investment and a small additional investigative effort. This is an example of the extra effort we are willing to provide because we genuinely have client’s best interests at heart.

Aside: Both Advisors are comfortable they are doing better for their client than Advisor C, who works for a brand name wall street firm, he is persuaded by risk to his career and purchases his own firm’s mutual fund for a client, believing the fees are “fair” and ignoring the after-tax consequences of the mutual fund as a vehicle. An Advisor’s firm should never profit from their client. The dividends the mutual fund distributes is inclusive of capital gains, unlike an ETF, removing the Advisor’s ability to control the amount and timing of when to recognize capital gains. This tax in-efficient investment exacerbates the case of the lying statements even more, inflating statement balances even more, but brand name firms are aware their clients are not likely to know this, they also know the hidden costs of that investment will never appear on statements, the statement balance looks better, and they earn more on larger statement balances anyway.

Unlike most firms we like to tell you What We Don’t Do For You.

If you are looking for honest help finding a financial advisor please read Help Me Find a Financial Advisor.

Can you become a better investor?

Learn more about how we consider the two pillars of wealth management, Financial Planning and Portfolio Management.